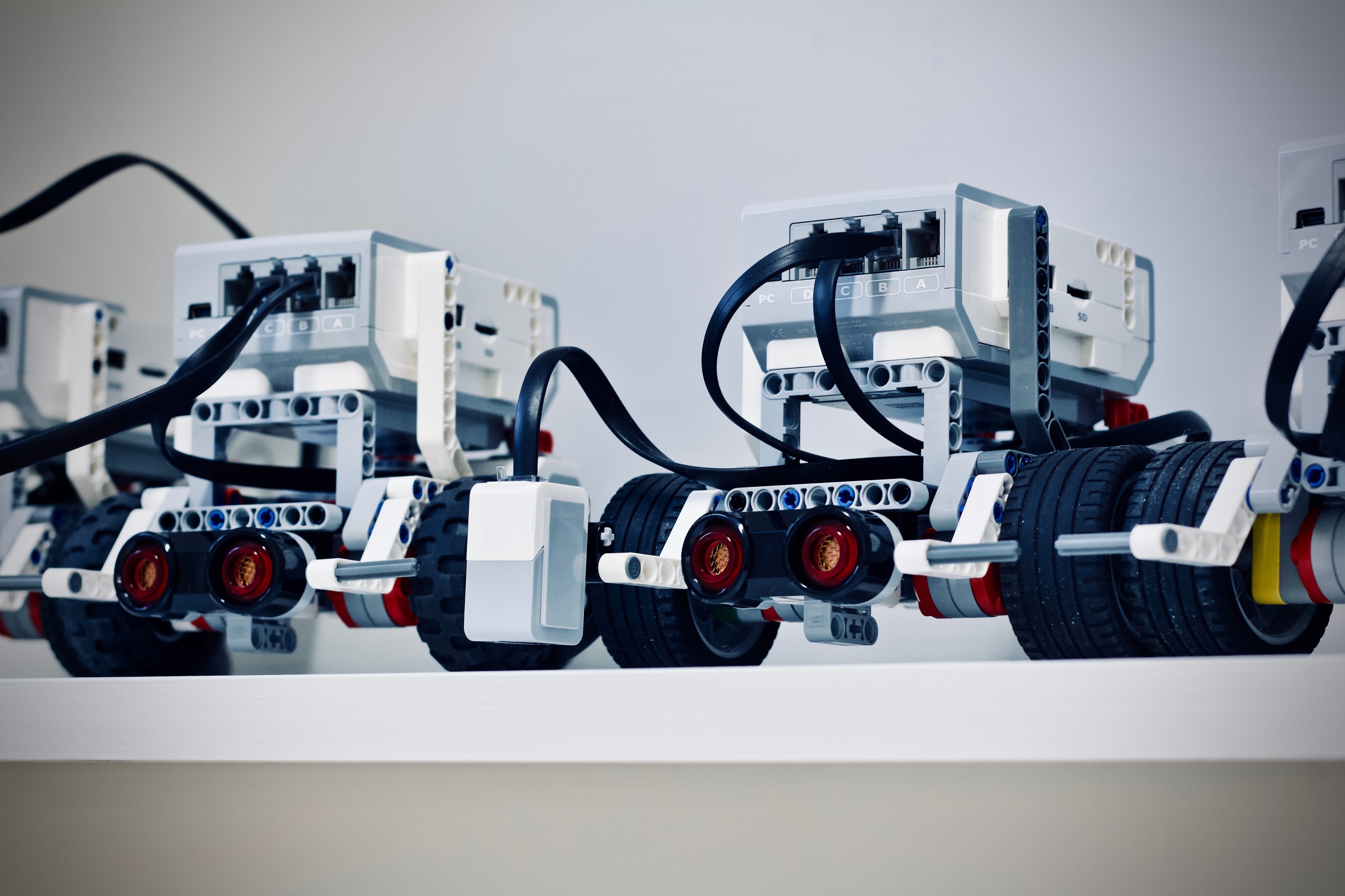

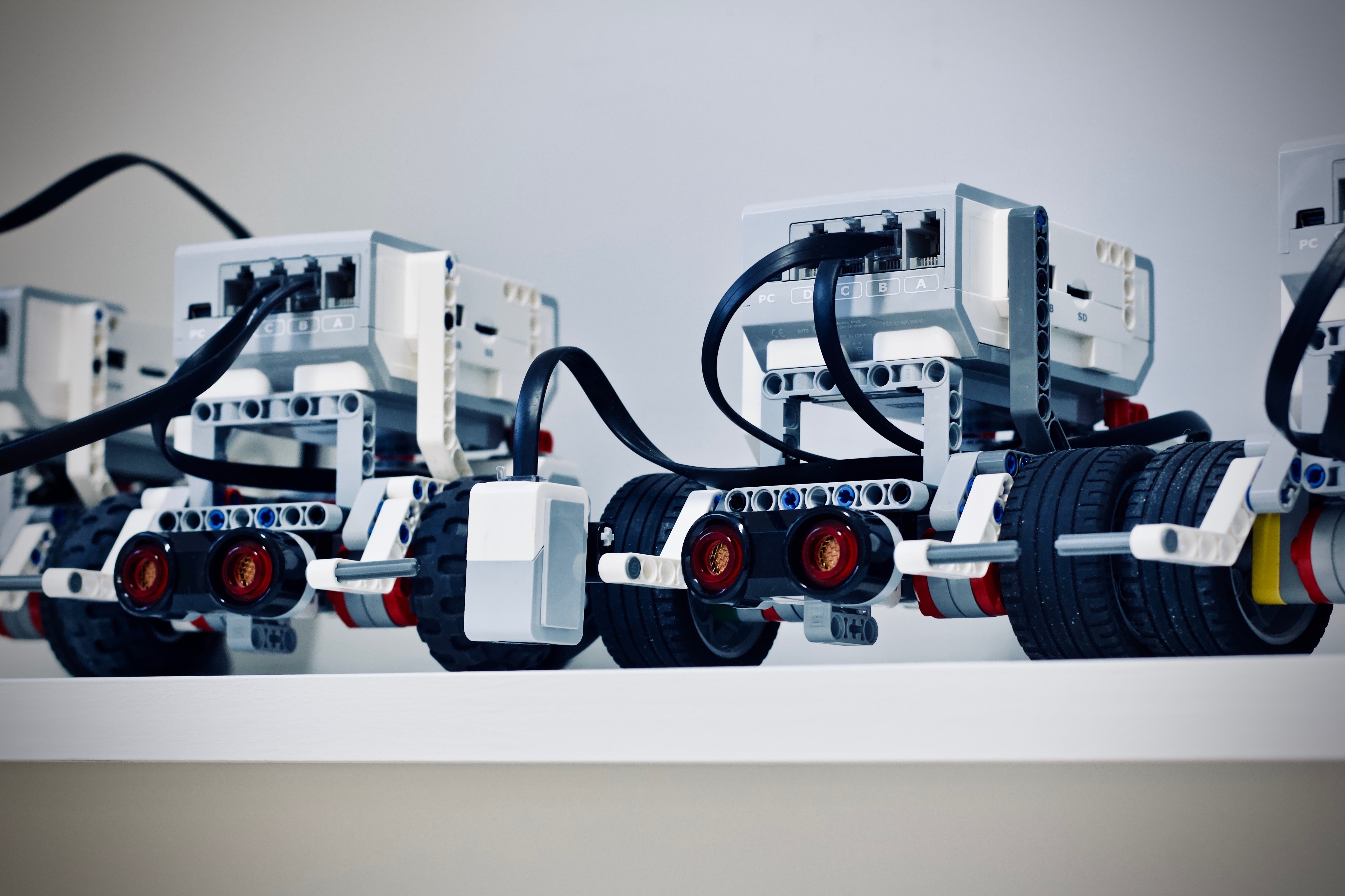

What is Robotic Process Automation?

Thanks to the rise of Robotic Process Automation (RPA) and Intelligent Automation (IA), back-office processes and other types of knowledge work are now able to be automated. Using RPA and IA, insurance companies can automate repetitive business processes to improve productivity, reduce costs, and create a better customer experience.

Likewise, thanks to RPA vendors like UiPath, Automation Anywhere, and WorkFusion, RPA implementation is easier than ever before.

Plenty of business processes in the insurance industry are repetitive and ripe for automation, including tasks within workflows such as underwriting, processing claims, and customer service. By automating these repetitive tasks with RPA bots, insurance companies can empower their staff to create a digital workforce. Human workers can focus more on strategic projects and customer service, while the bots handle specific tasks.

Benefits of RPA in Insurance

Besides automating processes, RPA benefits insurance companies by improving compliance, making claims management easier, and improving overall productivity. Here are some of the benefits of using RPA bots for your insurance company:

Process Claims Faster

Processing claims requires employees to collect information from multiple departments and enter it into different systems. It takes a lot of time for employees to process applications manually. The slow processing time results in a decline in customer satisfaction. With RPA, the bots can collect information from different systems and bring them all into one location to make claims processing a much easier process.

Boosts Data Accuracy

Unlike human workers, RPA bots perform data entry 24/7 without any distractions. However, it’s essential that RPA bots are programmed correctly so the right data is collected.

Boosts Data Accuracy

Unlike human workers, RPA bots perform data entry 24/7 without any distractions. However, it’s essential that RPA bots are programmed correctly so the right data is collected.

Quick Policy Cancellation

Canceling policies can take a lot of time. Employees need to interact with emails, CRMs, PDFs, a policy administration system, and Excel files to cancel a policy. RPA bots can hop around all data simultaneously, eliminating the need to move across various systems.

Standardized Processes

Standardized business processes have been shown to improve efficiency and reduce costs. By taking standardization one step further with RPA, insurance companies can have their bots working on standardized processes without having to worry about bots breaking the process. Many RPA tools include analytics features so you can see how your bots are performing.

Simplified New Business Onboarding

As insurance companies bring on more customers, scaling to meet the needs of every customer can be complicated. With RPA bots, you can automate most of the onboarding process to speed up the process while improving the customer experience.

Enhances the Power of the Current Infrastructure

Installing RPA bots doesn’t require new infrastructure. Companies can easily integrate RPA in their existing infrastructure to assist processes in various departments like sales, marketing, human resources, and others. Simply put, RPA enhances current systems to perform better than ever before.

Use Cases for RPA in Insurance

According to one survey, 34% of respondents view technological change as the biggest disruptor to their business. Due to new tech and new competitors, we can expect the business model for insurance companies to change dramatically in the near future. Let’s see how insurers can apply RPA in multiple types of operations inside their company.

Claims Registration and Processing

It’s a time-consuming process for employees to gather a vast amount of data from multiple sources when processing a claim. Current claims systems have now reached the point where they’ve lost flexibility and functionality. The slowness in claims processing makes customers unhappy. Utilizing RPA and AI can drastically cut down processing time.

RPA is capable of integrating various claims processing data from different processes. Companies can eliminate manual procedures like data extraction, error tracking, claim verification, and claim integration by using RPA bots. It will speed up processes, resulting in better efficiency and customer experience.

Underwriting

There’s a need for risk evaluation and exposures of clients in underwriting. Underwriters have to gather data from different sources and assess risks related to the given policies. It takes around 2-3 weeks for staff to go through a massive volume of data, analyze it, and reach a conclusion.

RPA bots help the company collect information from various internal and external sources, which inevitably saves time. Furthermore, it also automates the task of populating multiple fields in the system with relevant information. Then it generates a report or shows recommendations during the risk assessment. All these automated tasks dramatically reduce the time of underwriting and help managers to price their products.

Regulatory Compliance

Insurance companies must comply with strict guidelines for documentation and the generation of audit trails. The large volume of tedious and error-prone processes makes it challenging to stay compliant while serving customers.

RPA is a boon to insurers when it comes to helping out in regulatory compliance. Bots help validate customer information, generate regulatory reports, and send account closure notifications. There’s no need for companies to have employees go through operations for enforcing regulatory compliance manually.

Process and Business Analytics

Insurance companies need to measure performance to enhance the overall organization’s efficiency. However, the massive volume of operational tasks inside the organization makes it challenging to measure operational efficiency and locate the areas for improvement.

With automation, companies can easily monitor and measure the tasks performed by RPA bots. RPA also provides audit trails and help in regulatory compliance, which drastically improves processing time. The digital workforce’s implementation can help create streamlined applications and reduce claims and customer service response time, which boosts customer satisfaction.

Policy Admin and Servicing

Policy administration helps link the entire process of an insurer from quoting, rating, underwriting, and distributing customer services. Insurance companies rely on policy administration systems, which are expensive to maintain and update.

The current management software has helped organizations save time and labor, but it has also forced the staff to navigate extensive navigation via multiple applications. It has led to reducing operational efficiency. The implementation of RPA enables key members to accomplish a considerable volume of tasks within each process without including vast navigation across different systems. It automates redundant tasks, such as accounting, risk capture, tax, settlements, and regulator compliance.

RPA has helped players inside the insurance space to be free from a high-volume of backend processes. Now the insurance companies can deploy their backend staff to focus on higher-value work for generating growth.

Form Registration

Form registration is one of the critical insurance processes which is redundant. With RPA, the organization can perform this task 40% to save on FTE costs.

Policy Cancellation

Policy cancellation consists of a lot of transactional processes, such as tallying cancellation date, policy terms, inception date, etc. Implementing RPA can complete this task in 1/3rd of the actual time.

Sales and Distribution

RPA can ease the challenging activities involved in sales and distribution. Bots can create sales scorecards, stay compliant, send push notifications to agents, run credit checks, and perform similar activities linked to sales and distribution.

Finance and Accounts

RPA can take off a massive load from the finance and accounting departments. It can automate tasks like filling information, performing clicks, pressing buttons, auto-filling templates, etc. The Automation covers the significant parts of the daily banking reconciliation. It helps in lowering transactional costs along with a policy-cost footprint.

Integration with Legacy Applications

Insurance companies heavily rely on legacy applications for handling business processes. There is a need for integration with legacy applications for implementing ERPs or BPM systems. A well-planned RPA implementation can easily fit with the company’s legacy applications to assist in its workflow.

Insurance RPA Examples and Case Studies

Many leading insurance companies have implemented RPA and Intelligent Automation in the past few years. Here are some real-world examples of RPA in the insurance industry:

1. Prudential Finance

Prudential Finance has its headquarters in New York and has been around for over 140 years. RPA played a crucial role in managing cost, fostering strategic growth, and improving the customer experience for Prudential Finance.

The first application of RPA was for processing payment mismatches. It helped the company to identify if multiple policies were related to the same individual or not, by looking for the policy number inversion. Then the application would find out if there was a loan on the policy or not. If no loans were found, the company would reach out to the bank.

The company managed to plan RPA implementation in July 2016 and deployed it in only three months. By the end of the year, they managed to save $500k.

2. SAFE-GUARD

SAFE-GUARD has been in business for over 25 years, and it is located in Atalanta, Georgia. This company processes over four million contracts annually and has offered its products to huge auto companies like BMW, Ford, and Harley-Davidson.

RPA implementation allowed SAFE-GUARD to go from paper-heavy claims processing to automated routine claims processing. The first automation use case was for contracts and claims submission.

Their bots uploaded all paper documents to a centralized portal and accepted documents send via email, mail, or fax. Then the info was sent to internal teams further processing.

Later, bots pulled information of various categories from documents and stored them in the claims system. The application tracked and analyzed each step for determining efficiency high points and looking for opportunities to improve. The automation helped the company to reduce the time of documentation handling by 80%. And it grew productivity by 30% and increased customer satisfaction by 15%.

3. New York Life

New York Life is a huge multinational insurance company that has been in business for over 175 years. It processes over a million backend transactions annually. With RPA, they developed an automated backend application and named it Process Flow.

The new backend system allowed business administrators to change processes, make changes in steps and alter the order of steps. This automation helped to improve the overall productivity of the company.

Insurance RPA Vendors

The rapid rise of RPA is due in part to RPA vendors. Through an RPA vendor, insurance companies can implement pre-built bots for their standard processes and customize them as needed. There are three leading RPA vendors:

UiPath

UiPath is a popular RPA vendor for insurance companies. UiPath offers tools for businesses to deploy bots rapidly. Bots can accurately mimic and perform repetitive tasks, which boost the productivity of the company. UiPath enables organizations to automate simple office tasks. Employees can automate any processes via Document Understanding, Artificial Intelligence, and AI computer vision.

WorkFusion

WorkFusion is a big player in the RPA marketplace. Huge organizations like Humana and Chubb use Workfusion to lead their automation efforts. Workfusion allows companies to automate, optimize, and manage repetitive operations via its AI-powered Intelligent Automation Cloud.

Automation Anywhere

Automation Anywhere is a simple and intuitive RPA solution, which is easy to deploy and modify.

There are on-demand bots that you can use right away with a small modification to meet your needs. There are three types of bots for customers. One is to discover bot, which uncovers processes for creating bots. Secondly, there is an IQ bot for transforming unstructured data. These bots learn on their own. Lastly, it offers RPA analytics for measuring performance in different business levels.

How to Implement RPA

RPA implementation can see results in as little as four weeks—if implemented correctly. How do you implement RPA for your insurance company? Here are the steps for planning out an RPA project:

1. Find the Scope

You can implement RPA in various insurance operations like underwriting, claims processing, payroll processing, etc. Start by automating a small area and then scale it up. Starting with claims processing might be favorable because it consists of several repetitive tasks, and staff needs to gather information from many departments. It can take a massive load from your employees if you automate claims processing. Begin automation by assigning a group of employees and monitor their performance.

2. Calculate the Total Benefits

You need to know your baseline operational costs for calculating the overall benefits after the implementation of RPA robots. It might take around 1-2 weeks to calculate the baseline cost. Calculate the expenses of each process to know specific financial benefits.

3. Perform Analysis of the Current State Processes

Now you need to dive deep into mapping each process. Use process-mapping software like Microsoft Visio to demonstrate the steps for building your RPA use cases visually. Collaborate with employees of every department to map the processes. One can’t even miss a small detail like a mouse click in this step. IT staff and business analysts can help with this task.

4. Standardize Insurance Processes

You must plan and standardize every manual process to effectively implement RPA. Without standardization, you can’t implement RPA as the bots won’t know how to perform tasks.

5. Select an Insurance-focused RPA Vendor

Finally, you need to select a vendor for implementing RPA. Upon handing out your process-flow charts and other documents, the RPA vendor will help you implement the software. Most of the leading RPA vendors have Partner Programs and certified experts who can help make your projects a success.

Implement RPA with Productive Edge

By embracing RPA, banks can improve the customer experience while reducing costs and improving efficiency. Increased automation combined with more efficient processes makes the day-to-day easier for employees as they’ll spend less time on tedious manual work, and more time on profitable projects.

Productive Edge is a leading organization specializing in RPA implementation for insurance companies. We partner with our clients to enable consumer-focused, technology-powered RPA experiences that reimagine and transform the way people live and work.

By teaming up with other leaders in this field such as Workfusion, UiPath, and Automation Anywhere, we have been able to provide our clients with instant results, using tactics like data alignment, problem framing, road mapping, and piloting new RPA bots to help banks reach their RPA goals.

To learn more about how Productive Edge can help your business implement RPA contact us to book a free consultation.